As a further consequence of the strong recovery and the current imbalance between supply and demand, commodity prices soared in 2021 and are still high.

The prices of many raw materials, which have broken records or reached multi-year highs, continue to rise today.

«This is the case of food, wood, metals (although steel prices have fallen slightly in recent weeks due to the slowdown in the Chinese real estate sector) and energy,» exemplified the credit insurer Coface.

Present in more than 200 countries, Coface is a world leader in credit insurance and a recognized expert in commercial risks.

While concerns revolve more around natural gas supply – with prices remaining very high in Europe and Asia – than crude oil, the latter reaching a seven-year high at the end of January (at $91 per barrel). Brent).

In addition, the volatility of energy prices is exacerbated by geopolitical tensions on the borders between Ukraine and Russia.

Commodity exporters will continue to benefit from this particularly favorable environment. Therefore, the Gulf region is expected to record strong growth in 2022.

Commodity prices

The phasing out of OPEC+ oil production quotas will also be a driver of growth.

From Coface’s perspective, major events such as Dubai Expo (to be held until March 2022) and the World Cup in Qatar (scheduled to take place between November and December 2022) will have a positive impact on sectors such as tourism, construction and retail sales.

On the other hand, the improvement of relations between the Arab countries themselves and with Israel would represent new investment and trade opportunities for the region as a whole.

Although increased economic activity and energy prices will help reduce budget deficits, Coface expects the Gulf countries to follow prudent fiscal policies to contain debt levels. This would weigh on the growth rate of private consumption and investments

Although the direct effects of the pandemic on economies are diminishing with each additional wave, and the shock is concentrated in sectors affected by restrictions such as air transport, tourism and hotels, the appearance of the Omicron variant is still generating significant indirect impacts.

Due to the strong reaction of the governments of some countries that are fundamental in global supply chains, especially China, where stricter quarantine rules and partial closures have been imposed in several port cities, the current disruptions and shortages are expected to materials last even longer.

As a result, supply difficulties reached record levels this winter in the United States and Europe, both in industry and in the construction sector.

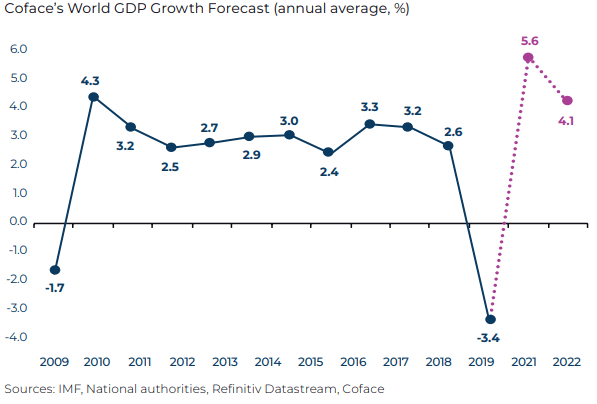

Consequently, Coface reduced its GDP forecasts for 2022 for several countries in Europe, as well as for the United States and China.

![]()