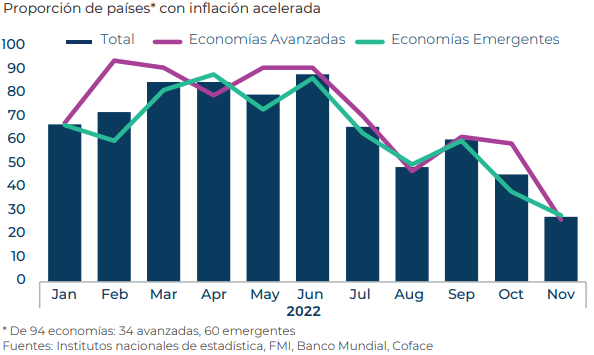

In a global outlook, the likelihood of recession has receded, while stagflation is taking hold, conclude Coface and the French Institute of International Relations (IFRI).

All of the following is part of a forecast from both released in February.

After starting with the worst possible auspices with the Russian invasion of Ukraine and rising commodity prices, 2022 finally ended on a positive economic -or, better, meteorological- note.

Although, as Coface and IFRI mentioned in their previous Barometer, the extent of the energy crisis depended largely on the severity of the autumn and winter in Europe, October was the most moderate month already recorded in climatic thermos, with November, December and the first half of January recording temperatures above the average of the past 30 years.

As a result, and thanks to a remarkable filling rate at the beginning of the period -obtained by paying a high price for LNG (liquefied natural gas) imports- European countries had very high gas reserves at the end of January, allowing them to avoid the specter of forced gas rationing in Europe this winter.

As a result, European economies should avoid the worst-case scenario, and Coface has left its world growth forecast for 2023 unchanged at 1.9%, a marked slowdown from 2022.

Coface

Given the confirmation of Coface’s stagflation scenario in advanced economies and the overall resilience of emerging economies, this French credit insurer revised its growth forecasts for all major economies by only a small margin.

This continuity is also reflected in its assessments, with only three countries and 10 sectors downgraded this quarter, after 95 accumulated in June 2022 and more than 50 in October.

Meanwhile, Coface has also upgraded the assessments of two countries, India and Burundi, and six sector ratings, mainly in the automotive industry (Middle East, Mexico, India), thanks to the gradual easing of tensions in supply chains.

While it is true that fears of an imminent global recession led to a sharp drop in commodity prices (metals, grains, oil) last summer, these same prices have remained relatively stable since then, at significantly lower levels than in the first half of 2022.

That confirms the sharp slowdown in industrial activity at the end of 2022 and the headwinds that continued to slow the Chinese economy kept Brent crude oil prices at around $80 per barrel in December, compared to an average of $105 per barrel in the first six months of 2022.

![]()