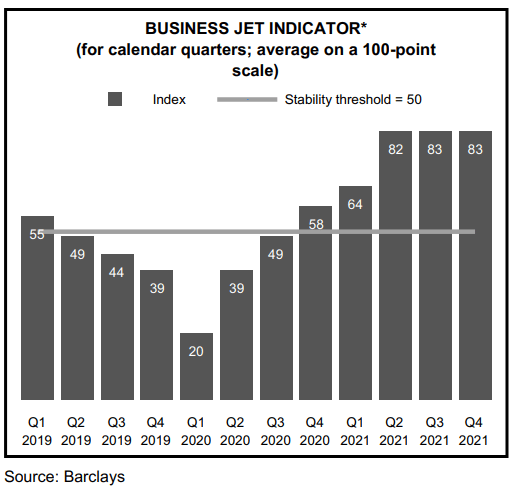

The business environment is reinforced by the Barclays Business Jet indicator, which jumped 25 points to 83 points for December 2021(2), thanks to growing interest from customers, the Bombardier company highlighted.

The Business Jet Indicator is a measure of industry professionals’ market confidence, collected through regular surveys of brokers, dealers, manufacturers, fractional providers, financiers and others.

Although the methodologies used in the calculation of the Business Jet Indicator may differ due to a change in the source of the data.

Business jet

Based on Oxford Economics Databank projections from January 19, 2022, global growth is expected to reach 4.2% in 2022, due to the continued recovery from the global pandemic.

For Bombardier, this economic outlook combined with low levels of second-hand inventory and a balanced aircraft order book should continue to support growth in the commercial aviation market.

The business environment is bolstered by the Barclays Business Jet indicator, which jumped 25 points to 83 points for December 2021, thanks to growing customer interest.

At the same time, Bombardier believes that the potential exit of certain legacy platforms in the industry should offset unit growth in new products.

Industry revenue is also forecast to continue to recover fueled by the increasing contribution of large aircraft to the overall industry delivery mix.

Perspectives

In the longer term, all the drivers of demand are in the right direction, according to Bombardier.

The creation of wealth and the continued rise of developing countries are expected to increase the client base of this company.

The retirement of older models combined with the introduction of new models will help meet the needs of new customers.

The evolution of new ownership models, such as fractional and charter businesses, will make business aviation even more accessible.

Commercial aviation is poised for growth and with the most comprehensive product portfolio in the industry, we believe we are well positioned.

Overall, industry indicators such as the Industry Confidence Index, US Corporate Earnings, and Pre-Owned Private Aircraft Inventory Levels trended in the right direction, reflecting strong improvements in market conditions compared to the previous year.

![]()