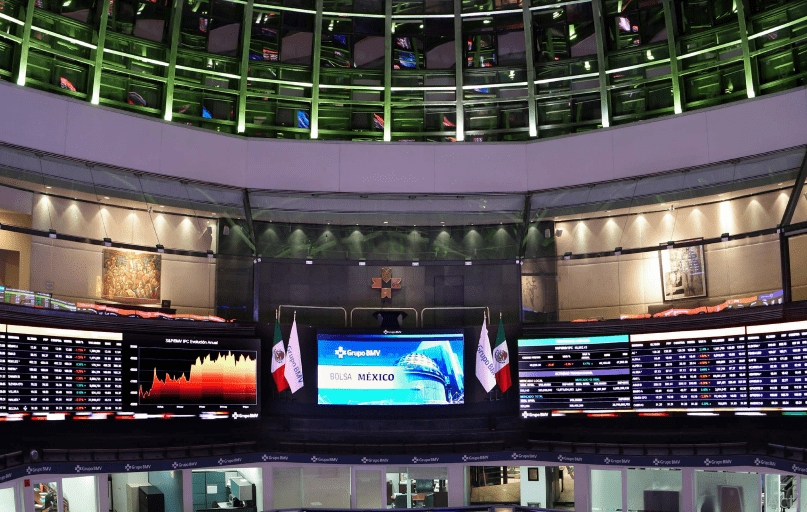

The BMV is a public company that operates by concession of the SHCP, following the regulations contained in the Securities Market Law.

BMV shares are tradable on the stock market; in June 2008 the initial public offering of shares representing its capital stock took place.

The BMV Group has been formed around the BMV, comprised of companies that offer comprehensive services to facilitate the operation and post-trade of the securities and derivatives market in Mexico.

BMV

The group operates, in addition to the BMV itself, a derivatives exchange, an over-the-counter (OTC) securities and derivatives brokerage firm, the central securities depository in Mexico where securities custody and settlement is performed, a securities clearing house and a derivatives clearing house, as well as a price valuation and risk management services company.

As of December 31, 2021, the BMV had 483 registered issuers, excluding the international quotation system (SIC).

On the other hand, BIVA received the concession granted by the SHCP in August 2017, starting operations on July 25, 2018, and has the support of Nasdaq‘s technological platform and its main shareholder Central de Corretajes, who in addition to BIVA owns two securities and OTC derivatives brokerage firms, as well as a price valuation firm.

BIVA

The creation of the new stock exchange has led to greater competition among companies and increased their participation in the stock market.

BIVA’s Board of Directors is the body responsible for complying with its corporate purpose, and its functions include planning, organization, management, evaluation, control and compliance with regulations, in accordance with the requirements of the Securities Market Law.

This Board is composed of temporary and revocable directors, who may be shareholders or persons not related to BIVA, of which at least 25% must be independent members and have experience, capacity and professional prestige.

The directors must perform their duties at all times free of conflicts of interest, avoiding having any personal, patrimonial or economic relationship with BIVA.

At the end of 2021, BIVA had 66 registered issuers, excluding those listed in the SIC.