The global outlook for 2023 for the automotive sector remains negative, according to French credit insurer Coface, which also offers debt collection, factoring and commercial information services, among others.

Factoring is an atypical and complex business with specific characteristics in international trade, through which companies and entrepreneurs assign or transfer their trade receivables to discount risks or finance their commercial activities.

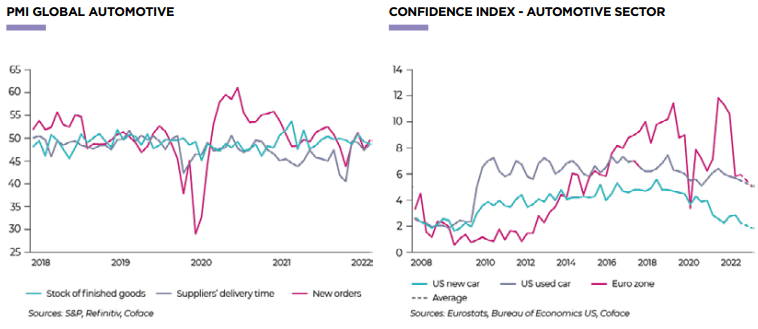

For Coface, 2022 has confirmed the structural difficulties that the automotive sector has been facing for several years, which have been compounded by a sluggish economic climate, monetary tightening by central banks and rising energy prices.

This macroeconomic context has had a major impact on the sector.

Coface expects this situation to continue in 2023, limiting manufacturing production (equipment manufacturers, automakers), as well as household consumption and distribution networks.

Automotive sector

Beyond logistical disruptions, the sector faces major structural challenges, the most important of which is the transition to low-carbon transportation.

The automotive industry as a whole is an important vector of innovation.

For example, in Europe it accounts for 32% (2021) of R&D spending, compared to 17% for pharmaceuticals, although the trend has been downward since 2017.

The decarbonization of the automotive sector takes several forms: regulatory/industrial in Europe, where the production of combustion engine vehicles will be banned from 2035; technological in Asia, where China has near hegemony over the lithium industry (lithium is essential for the manufacture of lithium-ion batteries); and geopolitical in the United States, where the Inflation Reduction Act restricts subsidies for the purchase of electric vehicles, to those produced on US soil.

The sector’s energy transition has brought to light the global competition between manufacturers, but also the power relations that exist in vertical value chains, especially between manufacturers and distribution networks.

Indeed, the Paris Motor Show in October 2022 gave a glimpse of the emergence of Chinese manufacturers and their efforts in the electric vehicle segment.

Second, automakers are steadily increasing pressure on upstream and downstream parts of the value chain.

Their profitability is improving in part by reducing the margins of subcontractors.

![]()