American Axle & Manufacturing Holdings (AAM) highlighted that automotive companies companies face pressure to invest in products aimed at electric vehicles.

This is part of a series of important trends affecting the markets in which the company competes.

Headquartered in Detroit with nearly 80 facilities in 17 countries, AAM reported sales of $5.507 million in 2021, up 9.5 percent year-over-year.

After recording capital expenditures of $216 million in 2020, the company invested $181 million in 2021.

On the one hand, intense competition remains, volatility in the price of raw materials, including steel, aluminum and other metallic materials, and the resources used in the electrification of vehicles and electronic components, shortage of labor and increase in labor costs, in addition to significant price pressures.

At the same time, there is a focus by auto companies on investing in future products that will incorporate the latest technology and meet changing customer demands, as certain original equipment manufacturers (OEMs) place greater emphasis on developing electric vehicles, hybrid and battery

For AAM, the ability to respond in a timely manner to the continual advancement of technology and product innovation, as well as the ability to source programs globally, are critical to attracting and retaining business in its global markets.

Automotive companies

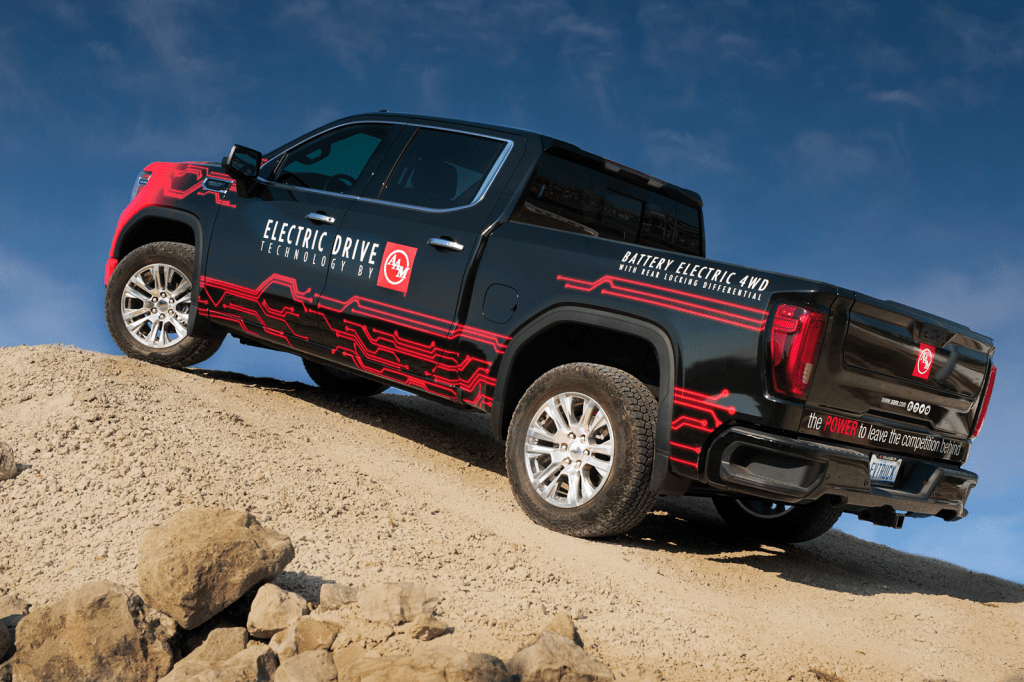

As the world’s leading Tier 1 automotive and mobility provider, AAM designs, develops and manufactures metal forming and powertrain technologies to support electric, hybrid and internal combustion vehicles.

But the Covid-19 pandemic has indirectly impacted AAM’s operations and financial results primarily through supply chain disruptions that have been caused or exacerbated by the pandemic.

During 2021, the automotive industry experienced, and continues to experience, significant supply chain disruptions, including shortages of semiconductor chips used by AAM customers, higher metal and commodity costs, higher utility costs, higher transportation, higher labor costs and labor shortages.

As a result, AAM has experienced increased volatility in its production schedules, including manufacturing downtime, often with little notice from customers, higher inventory levels and higher labor costs, which have impacted negatively its operating results and cash flows during this period.

AAM is a major supplier of transmission components to General Motors Company (GM) for its full-size rear-wheel drive (RWD) light trucks, sport utility vehicles (SUVs) and crossovers made in North America.

The company also supplies transmission system products to Stellantis N.V. (Stellantis) for programs including Ram heavy-duty full-size pickup trucks and their derivatives, AWD Chrysler Pacifica and AWD Jeep Cherokee.

![]()