Alpek recorded a 12.7% year-on-year reduction in its revenues in the first quarter of 2020, to $ 1.43 billion, affected by the COVID-19 pandemic.

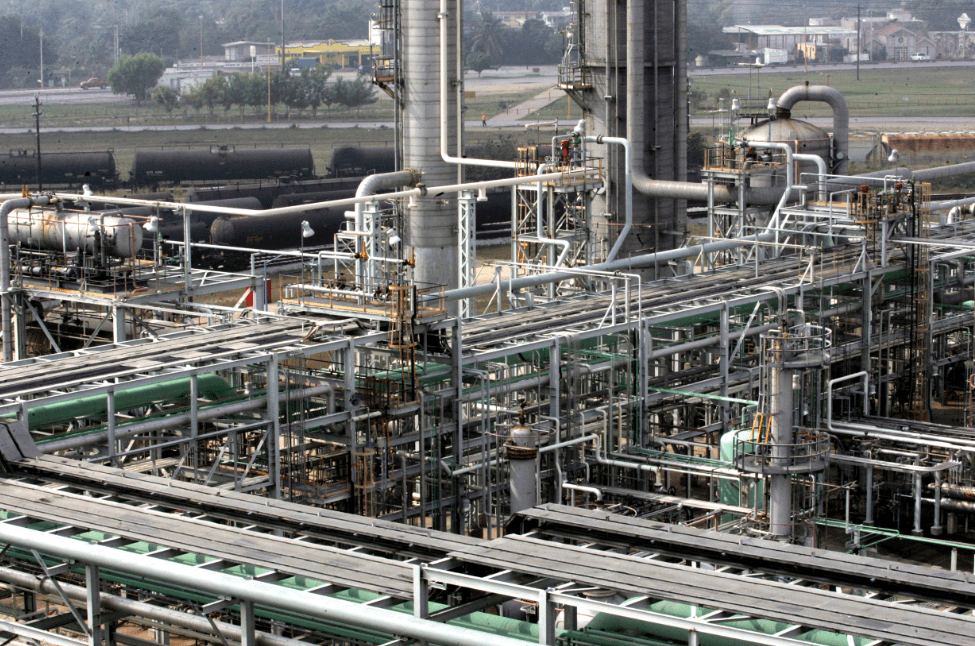

In addition to leading the production of PTA, PET, rPET and expandable polystyrene in America, the company is the only producer of Polypropylene and Caprolactam in Mexico.

The company is part of Grupo ALFA, one of the largest industrial conglomerates in Mexico.

Alpek and the coronavirus

The first cases of COVID-19 were recorded in China at the end of 2019, where strict measures during the following months, aimed at reducing the spread of the virus, had an impact on the operation of refineries and polyester producers in the region.

Financial results (millions of dollars)

For industry in general, these unscheduled production cuts resulted in:

Commodity price reduction

As demand for crude oil in Asia declined as a result of slowing production at refineries, and coupled with the lack of an agreement to reduce production globally in the first quarter of 2020, the average price of crude oil Brent decreased 49% during the quarter.

Consequently, the reference prices of paraxylene (Px) in the United States also decreased, 18% in the same period.

Improved polyester reference margins

Lower production from Asian polyester manufacturers, combined with strong global demand for PET-based products, led to a 21% rise in integrated polyester benchmarks in Asia in the first quarter.

Alpek: operations and finance

From an operational standpoint, the company produces raw materials for recession-resilient industries, including food and beverage packaging, consumer goods, and medical supplies.

All these industries have been declared essential activities in the countries where it has production centers, have continued their operations without interruption, and some clients have even requested higher volumes than expected.

Alpek has also responded to the effects of COVID-19 through financial decisions. The company reaffirmed its focus on financial stability through: the reduction of investments in fixed assets (Capex), with initiatives such as the extension of the pre-construction phase of Corpus Christi Polymers (CCP), a greater optimization of net capital of work, through better management of inventory accounts, suppliers and customers, and the decree of a lower dividend amount and better aligned with our estimated Flow.

In addition, Alpek improved its cash balance for the coming months, having committed and available lines of credit.

Recycled PET production

Alpek produced 62,692 tonnes of recycled PET (rPET) in 2019, an increase of 33% since 2018.

The purchase, at the beginning of the year, of an rPET plant in the United States contributed to this, consolidating Alpek as one of the main recyclers of this material on the continent.

RPET has a lower environmental footprint compared to other materials such as glass.

Alpek has already joined The Recycling Partnership in the United States, an institution focused on promoting initiatives in favor of the circular economy in the community.

In general, ALFA promotes proper waste management, as well as its confinement. Ten Sigma plants in Europe operated the Zero Dumping program, seven more than reported in the previous year. Alpek Polyester in the United States has reduced waste sent to landfills by 99%.

The income of this company totaled $ 6,216 million in 2019, an amount 11% lower than the previous year, the result of an 11% drop in average prices.

In 2019, Alpek sold its two cogeneration plants to ContourGlobal for $ 801 million, representing the largest asset sale in its history. The resources from said operation allowed the company to significantly strengthen its capital structure and decree a dividend payment of 143 million.