The Bank of Mexico (Banxico) released this Monday the results of Mexico‘s Balance of Payments in the Third Quarter of 2022.

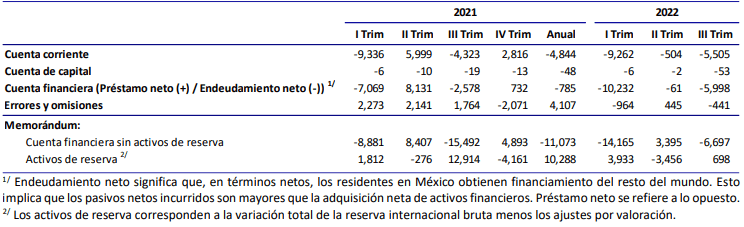

In the third quarter of 2022, the current account registered a deficit of US$5.505 billion.

At the same time, the capital account showed a deficit of 53 million dollars.

The financial account showed a net indebtedness of Mexico vis-à-vis the rest of the world, which implied an inflow of resources of 5.998 billion dollars.

This figure included an increase in reserve assets of 698 million dollars.

Balanza de Pagos (Millones de dólares).

The errors and omissions item showed a negative flow of US$441 million.

During the third quarter of the year, world economic activity showed heterogeneity among countries.

Although a moderate recovery with respect to the previous quarter is expected, mainly reflecting the reopening of economic activity in China and a rebound in growth in the United States, other economies reportedly showed a moderation in their pace of activity.

The evolution of the pandemic, particularly in China, as well as its possible impact on global economic activity and supply chains continued to contribute to maintaining an environment of high uncertainty.

Mexico’s Balance of Payments

In the period from July to September 2022, Mexico’s current account deficit was 1.6% of GDP.

This represents a moderate increase from the 1.4% recorded in the same period of 2021.

The annual growth in the deficit was mainly due to widening deficits in the oil trade balance and in the balance of services other than tourism.

However, these effects were partially offset by a smaller gap in the non-oil trade balance and an increase in remittances and tourism revenues.

During this period, international financial markets faced episodes of high volatility and a tightening of financial conditions.

These movements reflected concerns about persistently high levels of global inflation, expectations of accelerated interest rate hikes by major central banks, a global economic slowdown and rising geopolitical tensions.

In this environment, during the period reported, the Mexican economy continued to attract resources through the financial account, mainly in direct investment and other investment.

Thus, the financial account recorded net indebtedness vis-à-vis the rest of the world.