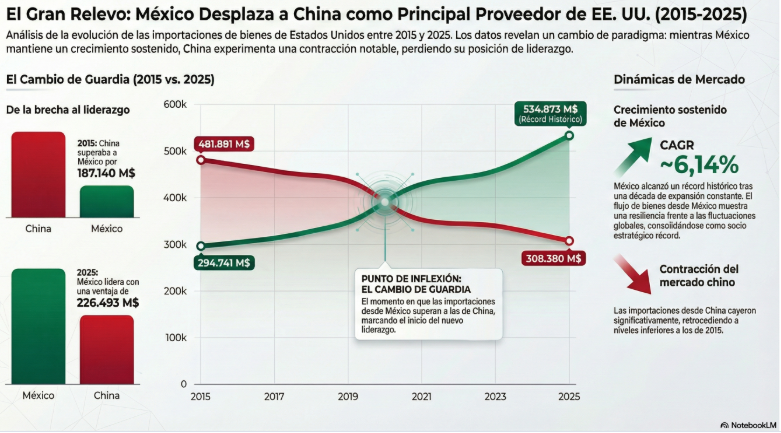

US imports of products originating in Mexico grew at a compound annual rate of 6.14% between 2015 and 2025, reaching a record $534.873 billion. This consolidated Mexico’s position as the main supplier of goods to the United States, in a context of supply chain and trade policy reconfiguration.

In contrast, US imports from China registered a negative annual rate of -4.37% in the same period. In 2025, they fell by $130.567 billion year-on-year, to $308.380 billion. The contraction was due to a strategic rotation of suppliers, not weak demand.

Foreign trade reconfiguration and nearshoring in North America

The performance of US imports of products originating in Mexico reflects an accelerated relocation of production. Since 2024, flows have exceeded $500 billion, strengthened by logistical advantages, trade agreements, and regulatory certainty under the regional framework.

The phenomenon is in line with trends toward nearshoring and geopolitical risk diversification. The replacement of Chinese supply with strategic suppliers has reoriented global chains. This process has favored Mexico as a manufacturing platform integrated into the US market.

Asian substitution and technological redistribution

China’s decline was partially offset by increased purchases from Taiwan and Vietnam, with increases of $85.168 billion and $57.339 billion, respectively. However, Mexico captured a significant share of the shift, especially in capital goods and advanced manufacturing.

In 2025, US imports of computers and telecommunications reached $165.9 billion. Although the automotive sector recorded a decline of $51.058 billion, the technological component offset the variation. Industrial integration made it possible to absorb strategic demand in value-added intensive sectors.

Strategic implications for foreign investment and trade policy

Mexico’s leadership in U.S. imports of products originating in Mexico is redefining the regional foreign trade map. Sustained expansion strengthens its position in critical supply chains, particularly in advanced manufacturing and intermediate goods.

For investors and foreign trade managers, the key takeaway is clear: the diversification of suppliers in the United States opens up opportunities in foreign direct investment, logistics infrastructure, and regulatory compliance. The challenge lies in maintaining competitiveness in the face of tariff adjustments and trade agreement revisions.