The peso gains 38 cents against the dollar: it is trading at 21.39

The peso closed the session with an appreciation of 176% or 38.3 cents, trading around 21.39 pesos per dollar, touching a minimum of 21.3582 pesos, a level not seen since March 13.

In the session, the peso was the second most appreciated currency behind the South African rand, which advanced 1.94 percent.

For its part, in the month the peso accumulates an appreciation of 2.33%, being the second currency with the greatest advance, behind the Brazilian real, which accumulates an appreciation of 3.70 percent.

In the session, the weight recovery was due to the following factors:

A return of risk appetite was observed in global financial markets. In the session, the Global Risk Perception Base Indicator (PPI) was -291 units, which implies a high risk appetite. The components of money market, commodities, currencies, capital and country risk showed consistent results with a greater appetite for risk. This happened due to a partial correction to the movements of the last sessions, when there was an episode of uncertainty in the financial markets due to a sale of stock market assets in the technology sector in the United States. In the capital markets, the S&P 500 closed with an advance of 2.01%, while the Nasdaq advanced 2.71%.

In Mexico, inflation for August was published at an interannual rate of 4.05%, exceeding market expectations and raising speculation that Banco de México could halt the process of cuts to the interest rate.

The peso and the pandemic

Going forward, the exchange rate could continue its downward trend towards the key level of 21.00 pesos per dollar, as long as optimism continues in global financial markets and progress in developing a vaccine against Covid-19.

There are several factors that contribute to the appreciation of the peso, among which are 1) the growth of exports in the face of greater US demand for goods produced in Mexico, 2) the flow of remittances that has reached record levels and 3) the stability of portfolio capital flows. With respect to the latter, in August the holding of government securities broke the downward trend that it had since March.

Foreign exchange

Although there are still no high capital flows to Mexico, the fact that sustained outflows have stopped has a positive effect on the performance of the Mexican peso.

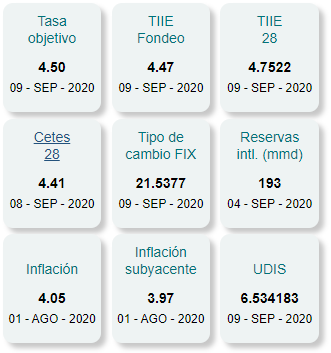

Indicators of Banxico

In the session, the exchange rate touched a minimum of 21.3582 and a maximum of 21.9430 pesos, the euro touched a minimum of 1.1753 and a maximum of 1.1834 dollars per euro. Finally, the euro peso touched a minimum of 25.2117 and a maximum of 25.8382 pesos per euro.

At the close, interbank prices for sale were located at 21.3900 pesos per dollar, 1.3002 dollars per pound and 11804 dollars per euro.

Gabriela Siller; PhD

Director of Economic-Financial Analysis.

Banco BASE

![]()