SHCP and SE will create commercial identification numbers

Mexico will establish commercial identification numbers in which the goods are classified according to the tariff fractions and the methodology for the creation and modification of said numbers, which will be determined by the Ministry of Economy (SE), with the prior opinion of the Ministry of Finance and Public Credit (SHCP).

The regulations on commercial identification numbers were included in the Decree by which the General Import and Export Tax Law is issued, and various provisions of the Customs Law are amended and added, published this Wednesday in the Official Gazette of the Federation (DOF).

The methodology will be published in the DOF through the Ministry of Economy.

The Ministry of Economy will submit to public consultation, which must clearly explain its operation and be permanently available on the website intended for it, the methodology for creating and modifying, and the procedure to follow for creating and modifying identification numbers. commercial.

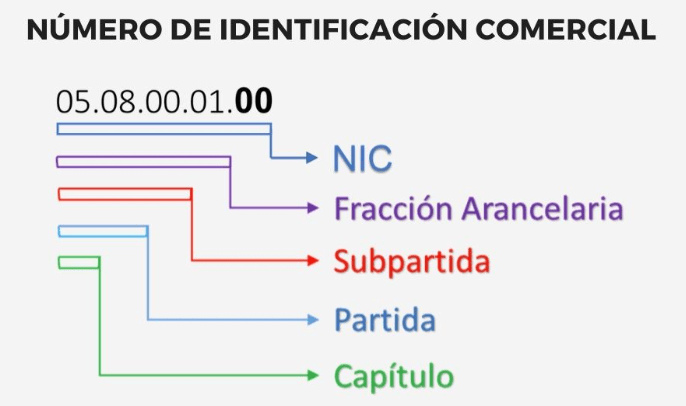

Commercial identification numbers

The classification of the merchandise will be made up of the tariff sections and the commercial identification number, which will be made up of two digits, which are placed in the posterior position of the corresponding tariff section that is declared, and which will be ordered in such a way progressive starting from 00 to 99.

The Ministry of Economy will announce by means of an Agreement published in the Official Gazette of the Federation:

- a) The commercial identification numbers of the tariff sections.

- b) The correlation tables of the tariff fractions of the Tariff, as well as the commercial identification numbers.

The importers, exporters, customs agents, customs agencies, confederations, chambers or associations, prior to the foreign trade operation they intend to carry out, may ask the customs authorities about the tariff classification and the commercial identification number of the goods. object of the foreign trade operation, when they consider that they can be classified in more than one tariff fraction or in a different commercial identification number.

Said consultation may be submitted directly by the interested party to the customs authorities or by the confederations, chambers or associations, provided that they comply with the requirements established in article 18 of the Federal Tax Code, indicate the tariff fraction and the commercial identification number they consider applicable, the reasons that support its assessment and the tariff fraction or fractions, or the commercial identification number or numbers with which there is doubt and append, where appropriate, the samples, catalogs and other elements that allow identifying the merchandise for its correct tariff classification and determination of the commercial identification number.